When do I trigger Unrelated Business Income Tax (UBIT) and what do I do about it?

When investing through a Rocket Dollar account, you should plan ahead of time to see how you might be impacted or can avoid unnecessary Unrelated Business Income Taxes.

What is the main difference between UBIT, UBTI, and UDFI?

UBIT (Unrelated Business Income Tax) is the tax itself that is applied by the government on such taxable income.

UBTI (Unrelated Business Taxable Income) or the income itself that is subject to taxation.

UDFI (Unrelated Debt-Financed Income) is a UBIT tax applied to debt financing, which is normally non-recourse (hard money) loans.

What is UBTI?

Unrelated Business Taxable Income (UBTI), targets ordinary income produced by businesses that are tax-exempt but don't qualify for one of the exceptions:

The ‘unrelated’ income necessitates a payment from the tax-exempt entity of Unrelated Business Income Tax (UBIT).

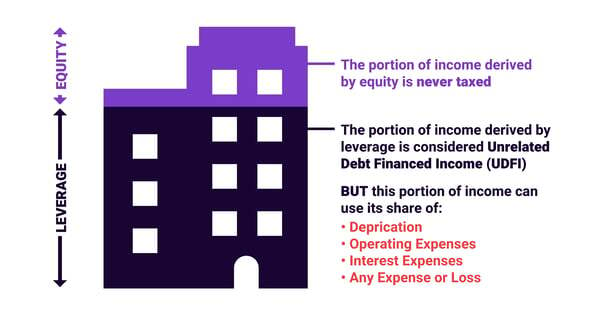

Common examples of the generation of UBTI in IRAs occur with private-equity & real estate-based vehicles. Additionally, debt-financed investments; which are often part of the investment structure for these asset classes can generate Unrelated Debt-Financed Income (UDFI). UDFI is assessed on any income generated from the debt-leveraged portion of the asset. An example is a piece of real estate with a 50% equity + 50% debt ratio that will have half of its total income tagged for UDFI. This generation of UDFI results in UBTI, requiring a tax payment from the IRA. So that half of the investment gains will result in a tax payment from the IRA, diminishing the tax-advantaged returns.

When related to real estate, UBIT is a tax on real estate activities that are not passive in nature. Rental income and capital gain income from the sale of real estate are exempt from UBIT. There is a special caveat to the capital gain exemption on the sale of real estate which does not allow it to apply when the real property was acquired with the intent to immediately sell it.

What typically has an exception from UBIT?

- Passive Investments Passive income is earnings derived from a rental property, limited partnership, or other enterprises in which a person is not actively involved.

- Rental Income (Rental income and real estate capital gains are also exempt from UBIT if the real estate was held for longer than 1 year)

- Interest Income, such as loan payments

- Dividend Income, from C-Corp stock or properly structure REIT dividends

- Capital Gains Income, except property or assets sold in under one year

- Royalty Income, intellectual property rights, land rights, oil and gas rights...

- C-Corps will pay a corporate tax, so C-Corps do not trigger UBIT

What is subject to UBIT?

- A passive investment giving off ordinary income

- Utilizing leverage in a non-recourse loan can lead to UDFI or Unrealized Debt-Financed Income. Self-Directed Solo 401(k)s are exempt from UDFI, making them popular with self-directed real estate investors.

- Real Estate Capital Gains less than one year

How much is the UBIT tax?

For UBTI income over $12,500, the tax is 37%

Why would I invest in anything that is subject to UBIT tax?

While the tax for UBIT can be high, many self-directed investors have strategies or investments that they are more confident in than traditional stocks and bonds. Over time, experienced self-directed investors learn how to minimize UBIT or how to target bigger investment opportunities through a strategy of a non-recourse loan. Visiting with a CPA can also find ways to write off UBIT taxes through business expenses to reduce the taxable burden.

Why do UBIT and UBTI exist?

These taxes were created by the Federal government so that a business paying a corporate tax would be able to compete fairly, and so that a business owner could not shelter large amounts of different types of business activity in a tax-exempt account. Over time corporate tax rates have changed.

What should I know about tax reporting for UBIT?

If your Self-Directed Solo 401(k) or Self-Directed IRA invests in an operating business (Limited Partnership (LP) or LLC) that sells goods or services and generates more than $1,000 in UBIT, the 401(k) or IRA must file IRS Form 990-T and pay the tax due from the 401(k) or IRA.

What if I still have advanced questions about UBIT and UBTI?

The 990-T form is a complex tax form that not all CPAs are familiar with. There can be specific needs for UBIT for each investment. You can contact Rocket Dollar to be introduced to a CPA that has expertise in this area. This CPA can do a complimentary call to learn about your situation and if they would be able to help. If you decide to work together, you and the CPA would agree to terms for hours worked or 990-T forms filed.

You may email info@rocketdollar.com or call 1-855-762-5383 to get in touch with these experts.

Want to read more?

- Want to understand UDFI & UBIT better?

- How to build a real estate empire with your Rocket Dollar Account.

- Investing in Private Equity with a Self-Directed IRA.

Was this article helpful?

Please sign in to leave a comment.