Direct Custody vs Checkbook IRA which is better for me?

Update

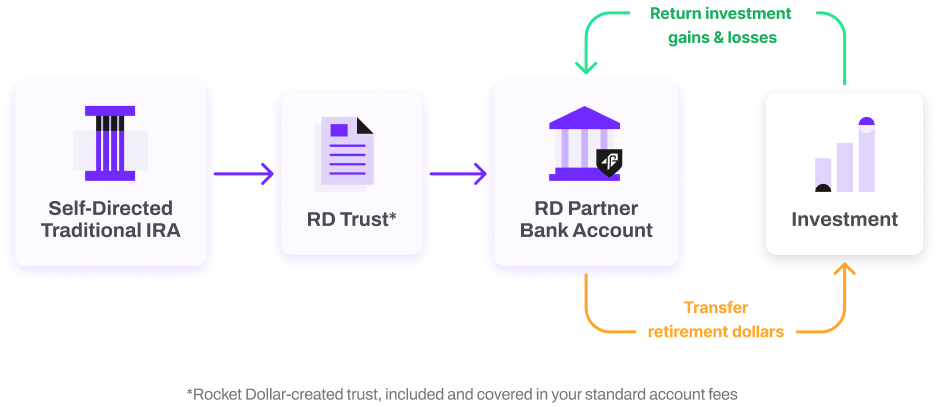

As of January 2024, Rocket Dollar began selling an IRA with a Trust to achieve checkbook control rather than a Colorado LLC. This was responding to feedback from California customers and investors, where high LLC taxes can be charged, and in response to increased reporting requirements for LLC beneficial owners.

A Direct Custody IRA or a Checkbook IRA are different ways to invest and save on taxes inside of an IRA. Investors use these to get similar tax advantages on alternative investments that they already enjoy when they invest in public stocks, bonds, ETFs, and securities.

The primary difference between the two types of self-directed IRAs is the client experience and ownership of the asset.

Direct Custody IRA: The Custodian, a Trust Company, holds the investment For the Benefit Of (FBO) the investor. The custodian sends all wires and reviews all deals.

Checkbook IRA with a Trust: An IRA, an individual trust, and a bank account at Rocket Dollar’s partner bank are created. The investor sends all wires and reviews all deals.

How do I figure out what is right for me?

Direct Custody Overview

Pros:

- Easier for alternative investing beginners or veterans looking to avoid complications.

- Initial setup is quicker than the checkbook IRA account.

- Rocket Dollar and the trust company can collaborate more with the investment issuer if you provide permission to do so, allowing you to stay out of the process besides authorizations.

- A clear process for one investment or with common deal paperwork. To review common investments in a direct custody account, like private placements, limited partnerships, real estate funds, pre-IPO stock, and secured or unsecured notes.

- Hands-on custodian help for when securities go public.

Cons:

- All investments must be reviewed by the custodian. Typical everyday investments should not be a problem. Deal review typically takes 48-72 hours, and funds are wired immediately after the deal review concludes.

- Because transactions and bill payments must be reviewed, this can slow down operations for high transaction volume assets, like individually managed real estate properties. (Examples are: high urgency payments to contractors, emergency payments to plumbers, many different rent checks coming in and being cashed, which need to be turned around to other expenditures quickly, and many private loans being issued and returned all at the same time).

- Rocket Dollar’s current offering direct custody product offering cannot invest directly into cryptocurrency. You can inquire about an affiliate of Rocket Dollar.

Structure:

Checkbook IRA, also known as "Checkbook Control" Overview

Rocket Dollars Self-Directed account options can be found on the homepage. To read even more you can review this article.

Pros:

- Recommended for sophisticated real estate investors who manage one or multiple properties, where a high level of transactions and billing are the direct concern of the IRA holder.

- Flexibility for advanced Cryptocurrency investors and custodial options.

- Speed for high-volume private lenders, as transactions are logged as soon as the bank receives them and can be sent to new opportunities the same day or the next day.

- Manage investments by having control of a bank account, checks, and debit card.

- Easy to use for those familiar with an entity or business bank account.

- There are no wait times for custodial approval, and you can send a wire or check for same-day funding of an investment. Funds must already be pre-loaded into the retirement account bank account for this capability

- Rocket Dollar creates the Trust, and introduces you to our partner bank.

- Partner bank has no minimum balance or activity requirements.

Cons:

- Only available at our Gold service price level.

- Prohibited transaction screening falls completely on the investor. While a custodian of a direct custody IRA does not take responsibility for prohibited transactions, deal reviews can catch many basic prohibited transactions that could endanger the IRA of the account holder to distribution penalties.

- Requires active participation by the account holder to send money or share wire information to receive money back. Since the client is the only account manager on the bank account, the client must initiate all money movement. This level of self-management can frustrate those who wish to remain hands-off.

- Requires working with an additional entity, our preferred banking partner.

- It takes longer to initially set up, at least two weeks with Rocket Dollar Gold or at least three weeks with Rocket Dollar Silver.

- Some investors are not familiar with Trust titling and investment trusts and prefer a simpler workflow and custodial oversight.

Structure:

Was this article helpful?

Please sign in to leave a comment.