Can I store IRA crypto in a hardware wallet?

There is no IRS guidance on cold wallets or USB-like key-storing devices. As of 12/06/2023, There is no current law specifically banning hardware wallets within IRA accounts in the IRS code. Investors can use hardware wallets according to the current IRS code but should be aware that the guidance may be changed, which would require actions to avoid prohibited transactions and protect the tax-advantaged status of your IRA. Many investors and thought leaders have analyzed if the McNulty case relates directly to cryptocurrency, but cryptocurrency is not specifically mentioned, as the case focuses on precious metals.

FAQs answered by Henry & Brendan on Youtube

Where should I hold my accounts on an exchange?

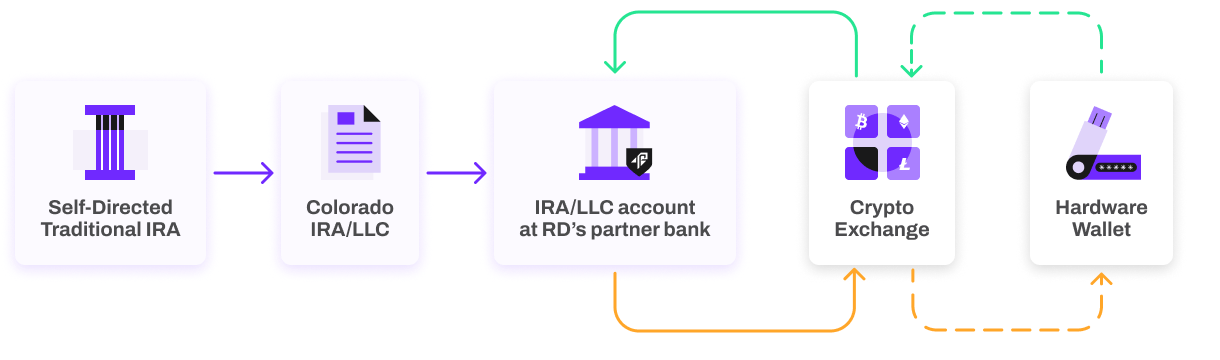

We recommend Checkbook IRA or Solo 401(k) account holders open exchange accounts at a place that registers retirement accounts through entity signup, allows for a W9 form to be submitted, and keeps their crypto in the centralized exchange accounts' hot or cold storage. See our instructions here for Gemini. We also have instructions for Cboe Digital and River Financial.

If an exchange sends out tax reporting while you are paying no taxes on IRA assets, it can lead to higher audit risks.

What if I don't want to hold it on an exchange?

Hot wallets or cold wallets have not been prohibited by the IRS, but there are no landmark cases that explore their use in IRAs. If you wish to do so,

- When first investing, you must do so with fiat US retirement dollars in the name of your IRA LLC/Trust or Solo 401(k). These dollars can fund a centralized exchange account that allows private wallet withdrawals.

- All retirement crypto wallets should be totally separate from any personal assets. New seed phrases, wallets, or devices that track transaction history should be clearly delineated.

- Purchase any hardware device with your IRA LLC/Trust or Solo 401(k) bank money.

- You should have a comprehensive record of all retirement accounts held crypto and a record of all your retirement crypto wallet transactions. This information should be produced quickly, easily, and comprehensively if you are asked to provide this information.

- You should avoid all privacy mixers and or blockchains (Monero, Bitcoin transaction tumblers, Tornado cash, etc.)

- When assets are distributed from your retirement account, you must do so through a centralized "off-ramp" exchange connected to your IRA LLC/Trust or Solo 401(k) Plan name.

What is the difference between a hot and cold wallet?

A hot wallet is called "hot" because it maintains some connection to the internet. These are usually used for smaller amounts of assets or assets that are transacted frequently.

- Pros: convenient, connects to various crypto online applications, defi, etc, with little counterparty risk.

- Cons: More susceptible to scams, hacks, theft, malicious links, social engineering, or a compromised computer/device.

- Often uses a 12-word or 24-word seed phrase, which is important for additional security purposes. Losing this combination of words or letting them fall into the hands of an untrustworthy actor could mean losing your assets.

- If you lose your password, you (or an untrustworthy actor) can enter the 12-word seed phrase to restore access.

- You should have a physical backup of your seed phrase in a very secure place. Paper, etched metal, etc. This is commonly stored in the home or a safety deposit box.

A cold wallet is called "cold" because it has no connection to the internet. These are used by a variety of crypto investors who value security and have higher asset levels.

- Pros: one of the highest possible ways to secure your cryptocurrency, cold wallet applications, little to no counterparty risk.

- Cons: Adds small amounts of inconvenience to access assets for high-security tradeoffs, a physical device that could be lost or stolen, cannot access crypto while traveling if you do not physically have your device.

- Some hardware wallets can, by instruction of the user, turn themselves into hot wallets for limited periods of time to make it easy to complete crypto transactions and then return to cold wallets once unplugged from a computer, similar to how an online application will automatically log off.

- Often uses a 24-word seed phrase, which is important for additional security purposes. Losing this combination of words or letting them fall into the hands of an untrustworthy actor could mean losing your assets.

- You should have a physical backup of your seed phrase in a very secure place. Paper, etched metal, etc. This is commonly stored in the home or a safety deposit box.

Cryptocurrency, when removed from a centralized exchange, is stored by the security of the blockchain. This security and access are usually validated and supported by crypto miners or crypto stakers, who run computers and receive a reward for supporting the network. As long as a few of these miners' or stakers' computers are still operating and you have your seed phrase, you will always be able to access your assets.

Are there any risks to using a hardware wallet?

Without regulation, irresponsible investors could be subject to risk in tax court. Mishandling crypto, whether in hot or cold wallets, could be a prohibited transaction, and you risk penalties including IRA distribution and or Solo 401(k) fines if it is mishandled. The IRS has frequently prohibited or targeted assets held in the investor's home instead of being held by a financial company, custodian, or vault. Crypto assets are not stored at home but on the blockchain. Still, it is undeniable that hot wallets and hardware wallets assist in managing a seed phrase and the non-custodial nature of cryptocurrency away from exchanges. The most recent ruling on McNulty vs Commissioner was about precious metals. The term "unfettered command" was used frequently, expressing concerns where an investor has too much control or unfettered access over their IRA assets. This case was about precious metals, not cryptocurrency, but in the absence of regulations, investors would be wise to consider current laws in other assets.

Rocket Dollar employees have no partner, admin, or key-sharing authority over your cryptocurrency account with the Checkbook IRA model. As the manager/trustee of the IRA, you get to choose your security method. When choosing your security, always make sure your IRA LLC/Trust is titled in as many places as possible and, if possible, for your crypto wallet.

We will assist by helping customers solve high-level issues with our partner exchanges, but will never be able to move any crypto on your behalf.

What if I would like to know more?

We have had a few advanced crypto webinars & FAQ videos that extensively cover currently known regulations and how crypto wallets, hot wallets, and cold wallets could be impacted. We suggest clicking through the YouTube-tagged chapters for wallets. Be aware as regulations change, old videos could become outdated.

Webinar:- FAQs on Hardware Wallets and Crypto IRAs with Henry & Brendan

- Crypto Taxes and Crypto IRAs Part 1

- Crypto Taxes and Crypto IRAs Part 2

- Crypto for a Self-Directed IRA

- Crypto and Real Estate Asset Protection

Was this article helpful?

Article is closed for comments.