How do I use my Rocket Dollar SDIRA or Solo 401(k) to invest in cryptocurrency like Bitcoin & Ethereum?

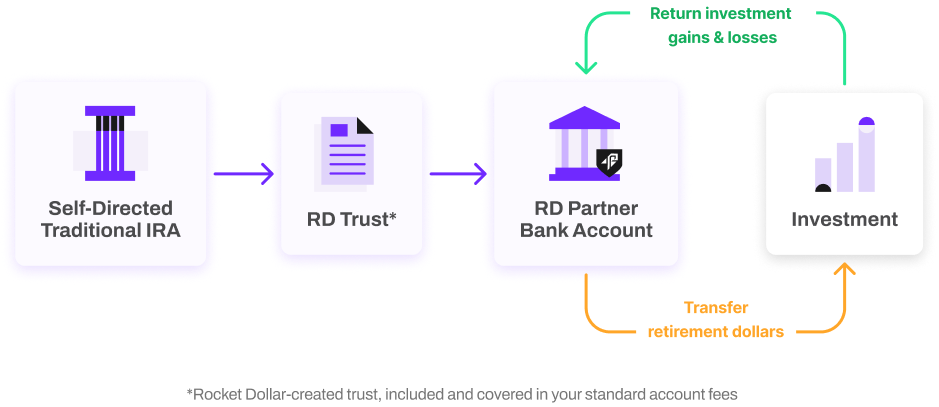

Use a Rocket Dollar Checkbook IRAor Self-Directed Solo 401(k) to buy cryptocurrency (Bitcoin, Ethereum, & more), Blockchain-based Startups, and Crypto Funds all in your tax-advantaged retirement portfolio.

-

-

Open the Exchange account in the name of IRA LLC/Trust or Solo 401k Plan.

-

Always use separate exchange accounts or wallets for your retirement dollars. Never co-mingle with an account in your name.

-

At this time, you can access private placement fund opportunities but cannot buy individual crypto coins in a Rocket Dollar Direct Custody IRA. This means a managed fund will be running a passive or active strategy for you, and will use its own security and crypto custody protocols. Those wishing to own individual crypto coins should pursue the Checkbook IRA product at Rocket Dollar. Direct Custody IRAs usually cannot allow outside wallet interaction as part of their product and compliance, as IRA custodians are responsible for holding funds of assets for customers.

-

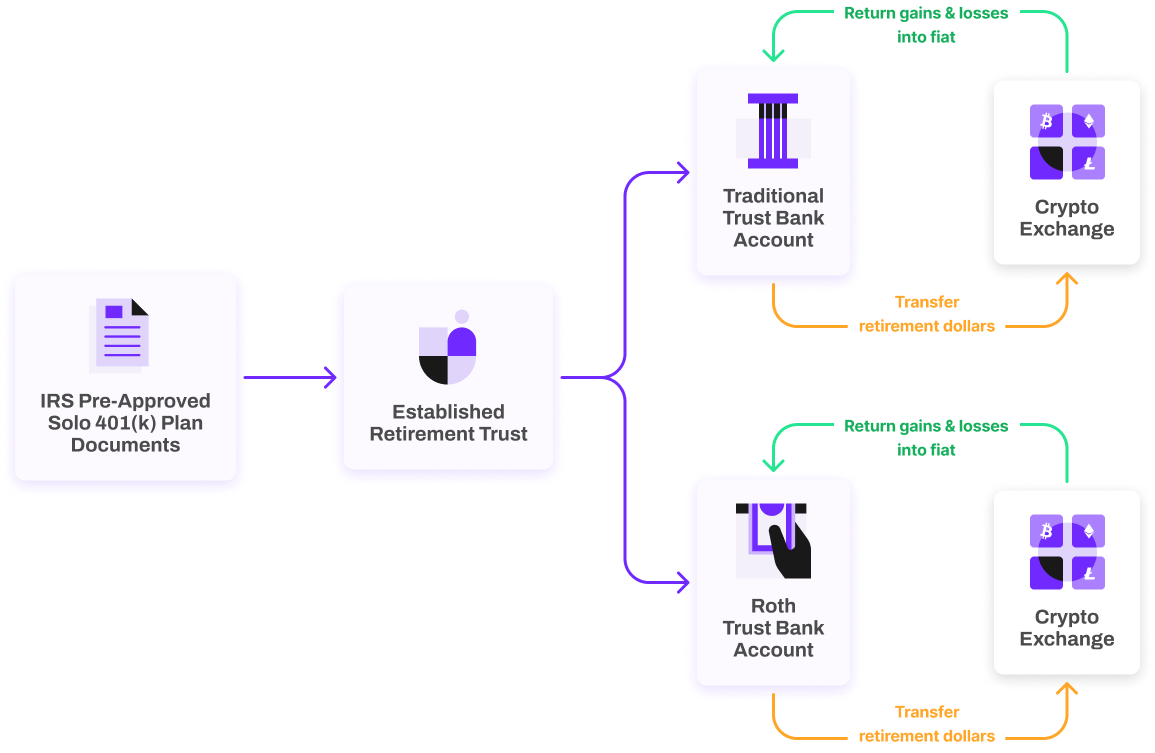

Open the Exchange account in the name of your Solo 401(k). If the provider is not familiar with a Solo 401(k) they should open your account as a retirement trust.

-

Always use separate exchange accounts or wallets for retirement dollars vs your dollars. If you make investments with both Traditional and Roth accounts, those must be segregated into different wallets or sub-accounts as not to commingle different tax statuses.

-

Control your exchange and storage options.

Opening your crypto exchange account, either in the name of the IRA or Solo 401(k) Trust, can take much longer than standard customer signup. Accounts can take up to two weeks to open during normal times and can be significantly longer during crypto all-time highs because of significant customer interest.

Opening a Checkbook IRA, and bank account have the benefit of quite a few freedoms, but we need time to get every bit of your account open.

To speed up funding your exchange account, as soon as your Checkbook IRA or Solo 401(k) is created, you can take the creation documents and apply them to the exchange as quickly as possible. While we are working on your retirement rollover and getting your account funded, you can be completing this independently. Opening an entity/Solo 401(k) retirement trust account WILL take longer than the average basic, individual, consumer crypto trading account.

During crypto all-time highs, we always receive tremendous interest in Checkbook IRAs to invest in cryptocurrencies. This can slow our fulfillment team down because of the sheer volume of accounts we need to open for customers. Even if you are eager to enter the crypto markets, remember to dollar cost average or purchase carefully with price alerts and price limit orders to protect your retirement savings.

-

-

There are plenty of paths to invest in digital assets. The range of options can help offer a choice for various investor experience levels and risk tolerance.

-

Cryptocurrency directly purchased through an Exchange, Market Maker, or private party -Your retirement account will own cryptocurrency coins on a centralized exchange or offloaded into a wallet named for your retirement account. If you use a private seller, be sure not to deal with a prohibited person, like your personal dollars or close family/business partners.

-

Digital Assets Managed Fund- Investing through a Managed Fund product, which a 3rd party controls. Traditionally a hedge fund type structure, where the managers trade digital assets on behalf of investors.

-

Venture investments into Blockchain Startups that are funding projects & companies involved in the space (in Fiat US Dollars or by purchasing their token offerings)

-

Security Token Offering (STO) - Token issuance is a way to digitize private assets. The blockchain technology implemented by an issuance platform is used to administer investor assets through a digital ledger. Whatever token you buy, you must make sure only your IRA benefits. You cannot redeem any personal real-life benefits, or have those benefits pass over to your personal account.

-

Using your cryptocurrency or tokens your IRA holds to trade for other assets - You can trade your coins without capital gains taxes to different coins. Your Checkbook IRA can go out and use cryptocurrency to buy assets from platforms that accept cryptocurrency or tokens as valid payments. Simply report the new investments on the Rocket Dollar investment tracker.

-

Staking or Staking - It is best to use Staking or Mining services that automate most of the work of the process and takes it out of your own hands. If you plug a mining rig or staking device into your home power bill, and work with your own hands to maintain the device's function can be seen as a prohibited transaction and invalidate your IRA.

Please give us a call or visit our Partners Page to discuss the working relationships we have across the crypto space: 1-855-762-5383

-

-

Fees in this area have been startlingly high, both from the IRA provider and their exchange and custody partners. Rocket Dollar’s offering starts with our $360 signup fee, monthly maintenance of $30 to maintain the account's tax-advantaged status. Any trade or network fees are set by the centralized or decentralized service you are using.

Bitcoin IRA products have often been sold with high built-in service and transaction fees, as well as with limited coin & token access... A Rocket Dollar retirement account provides the ability to invest in a variety of assets, not just cryptocurrency. With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency

In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital. The Rocket Dollar model allows for greater flexibility around storage & custody for the Checkbook IRA assets.

- You should carefully follow instructions to make sure everything is registered correctly in the name of the IRA.

- Here are instructions for Kraken

- Here are instructions for Gemini

- Here are instructions for CBOE Digital

- Here are instructions for Coinbase

- Here are instructions for River Financial

-

You can, but Rocket Dollar cannot provide guidance on the application process. It is important to have the EIN in the name of your custodian, and if that is not accepted, the EIN of your IRA LLC. Some exchanges might still do a personal identity check, but it is important that final documentation is clear that your crypto belongs to your IRA.

-

Your retirement account owns the coins. Whatever exchange you use is the final direct crypto security. Rocket Dollar's partner holds custody of your IRA, which is the single-member (100% owner) of your LLC/Trust, and you are the manager/trustee of that LLC/trust, making all investment and storage decisions. Using the proper ownership identifiers your retirement account can invest in any cryptocurrency such as Ethereum, Bitcoin, Litecoin, as well as a Security Token Offering (STO). If you use an exchange, but it must be able to properly handle your IRA LLC/Trust or Solo 401(k) Retirement Trust, and title your assets into a retirement account name instead of your own.

With the exchange, you can set up a storage option that works for you and your retirement account as long as you avoid a prohibited transaction.

-

No, there are turnkey and managed solutions. You can consult storage options with our partners or consider digital assets managed funds. Whatever option you select, make sure to work with a provider that has a trusted storage option and account security.

-

No. unfortunately, there is no infrastructure or compliance method to account for your contributions this way.

All new retirement contributions must be made with Fiat cash. Then you can buy crypto from an exchange or trusted private party. Once you own that cryptocurrency, you can trasact as many times as needed. Be careful not to mix with your own personal crypto and retirement crypto, similar wallets/accounts, or a prohibited person, as that could be a prohibited transaction.

-

No, at this time, due to special needs for custody, Rocket Dollar IRAs with no LLC or Trust cannot offer direct access to Cryptocurrency. California customers can buy through options like a crypto-managed fund opportunity. A customer would have to open a Self-Directed Solo 401(k) or a Checkbook IRA. If they are in California, they would have to pay the franchise board tax fee. Rocket Dollar continues to expand offerings to our customers to reduce friction.

If you would like to stay updated on progress, please email info@rocketdollar.com and ask to be included in updates.

Want to read more?

- How are cryptocurrencies taxed?

- Why cryptocurrency could have a place in your portfolio. A look into the cryptocurrency options.

- Cryptocurrency with Mark Peck on the Rocket Your Dollar Podcast.

- The Basics of Self-Directed Investing in Cryptocurrency.

Was this article helpful?

Please sign in to leave a comment.