I've worked with investors and custodians on Self-Directed custody IRAs. What processes are different for Self-Directed Checkbook Accounts?

The process for a Checkbook style IRA LLC is different from one with a custodian. Deal reviews are handled between the investment issuer and the customer and their IRA LLC NOT Rocket Dollar.

How is Rocket Dollar different?

Normally I submit paperwork to get approved on a custody platform, then the custodian releases the investor's fund to my fund/investment issuers bank company. How is this different?

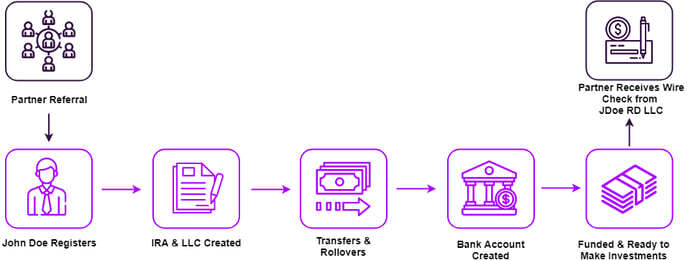

The process with Rocket Dollar is fundamentally different. IRA LLCs are slightly more complex to set up, but once they are functional, they are very easy to complete a deal and receive funds.

What are some advantages to this process?

- Deal approval is instant. As long as a customer has their account ready, as the manager of the LLC of their IRA, or the trustee of their solo 401(k), they can sign as LLC manager or plan Trustee to release funds. This works for current AND future investments.

- Refer customer, and then just send wire information! It will take us time to open the account, but during this time, you can sit tight and Rocket Dollar will take care of it. When the customer's account is nearing completion, send wire information. (2-4 weeks depending on if they chose a faster Gold Account for $600 and $40 a month or a Silver entry-level price account at $360 and $30 a month)

- Less back and forth or a triangle of telephone communication between the investor, custodian, and issuer. Because the customer can sign paperwork and release funds, you don't have to worry about dealing directly with Rocket Dollar on a busy week!

- Easy Fair market value reporting (also known as FMV). When it comes to year-end, the customer self-reports the value of their assets. Just send the value of the investment to the customer and they enter it into the investment tracker.

Instead of going through the entire process of getting approved, the first step is to…

- Introduce the customer to Rocket Dollar and have them sign up on app.rocketdollar.com/signup.

- The customer can call into the sales line if they wish. We will help answer any questions on retirement, the basic rules of these accounts, or the process. Account creation will not start until the customer finishes and pays in online signup. You as the partner can feel free to step away at this moment.

- We create an IRA, LLC, and Bank account for the customer. (for a solo 401(k), we create a plan, bank accounts, and appoint the customer as the trustee of their retirement plan)

- We work with the customer on getting their retirement funding. This could be from a contribution, but could also be from an old retirement account transfer. Customers can start the process with their IRA right from the Rocket Dollar dashboard. Any customer trying to transfer a Solo 401(k) or old work retirement plan can contact our support team.

- The funds arrive in the customer’s new IRA LLC bank account. (or Solo 401k trust account)

- As we have appointed the customer as the manager of their IRA LLC (or trustee of their Solo 401k), they can now truly “self-direct” where the investments of their IRA/Solo 401(k) are going. A deal review process between the investment issuer and Rocket Dollar is not necessary. Rocket Dollar does not receive any deal documentation. You go through your investment review process, risk assessment, or any compliance necessary with the customer.

- You prepare sub documentation, except the customer's personal name is NOT on the document. Only the IRA LLC Name/Solo 401(k) Plan name should be present. Typically, this titling defaults to JDoe RD LLC, or Customer Business Name PSP, but a customer could have a customer LLC or plan name. The only signer should be “Jane Doe, Manager” for an IRA LLC, or "Jane Doe, Trustee". The customer can find their account titling information in documents in their Rocket Dollar dashboard.

- You provide wire information to the customer, who will then enter that bank transfer info on our partner bank portal. The customer can wire or ACH money to you as soon as it lands from their retirement rollover/transfer. Rocket Dollar cannot wire the money and has no authority to do so. As the LLC manager, the customer is the only one with the power to do so.

- For investment returns, interest, rent, payouts, sale of assets, etc, all investment gains and profits should return to the same bank account the customer wired from. The customer can provide that information. ACH transactions can be up to $100,000 and will avoid wire fees for the customer.

- The customer can upload the sub docs into their Rocket Dollar dashboard. A document hub is a place where a customer can gather and quickly refer to an

- For ongoing compliance, once a year, it is necessary for Rocket Dollar to help report the Fair Market Value (FMV) for the Customers IRA. This a required on IRS form 5498 and is needed for every IRA in America. Rocket Dollar will usually start reminding customers about this requirement in December and it is a hard deadline usually in the first few weeks of January. You can provide this information to the customer, who can upload that into their Rocket Dollar dashboard. Together with the customer’s cash balance, and all investments in their IRA, Rocket Dollar is able to report on the customer’s IRA value to the IRS. Sharing FMV data directly with Rocket Dollar is unnecessary. Making sure your client has up-to-date information on the value of their investment and any/all accounts ASAP in the new year will be the most helpful. Customers who have a Solo 401(k) have extra reporting requirements once their account value is over $250,000. Customers with a Solo 401(k) are still required to report investments in the Rocket Dollar dashboard.

What if a prospective investor is already a Rocket Dollar customer?

You and the customer can skip to step 7. This is what makes the checkbook style IRA so simple, is that once an investor is a Rocket Dollar customer with a funded account, they can wire funds and start completing investment sub docs as soon as they are ready.

What If I’m an advisor, family office, or involved investment provider that helps my client with their account?

Please let our sales and partnership team know at info@rocketdollar.com. Being a tech-forward company, it is our goal to develop interested party capabilities, while also making sure our customer’s privacy and financial data security can be respected. Feedback or capabilities that would be helpful are greatly appreciated and we look forward to different ways we can continue to innovate to make your experience smoother.

You can ask to be CC'd on support emails, but that request must be initiated by the customers. Read more here.

Does Rocket Dollar have an API?

Rocket Dollar also has an API that can assist with account creation and core functionality if it made sense for your business.

Was this article helpful?

Please sign in to leave a comment.