Am I eligible for the Self-Directed Solo 401(k)? Is it the right product for me?

In order to be eligible for the Self-Directed Solo 401(k) account, you must be self-employed and have no full-time employees. Further eligibility requirements and exceptions are below.

What do I need to make sure I qualify for the Solo 401(k)?

1. Income from the below qualifies...

- Sole Proprietorship

- LLC

- C Corporation

- S Corporation (must contribute from income, not distributions)

- Limited Partnership (some Solo K plans do support this but Rocket Dollar does not support a multi-owner Solo K structure at this time. The partnership must only be a spousal married pair.)

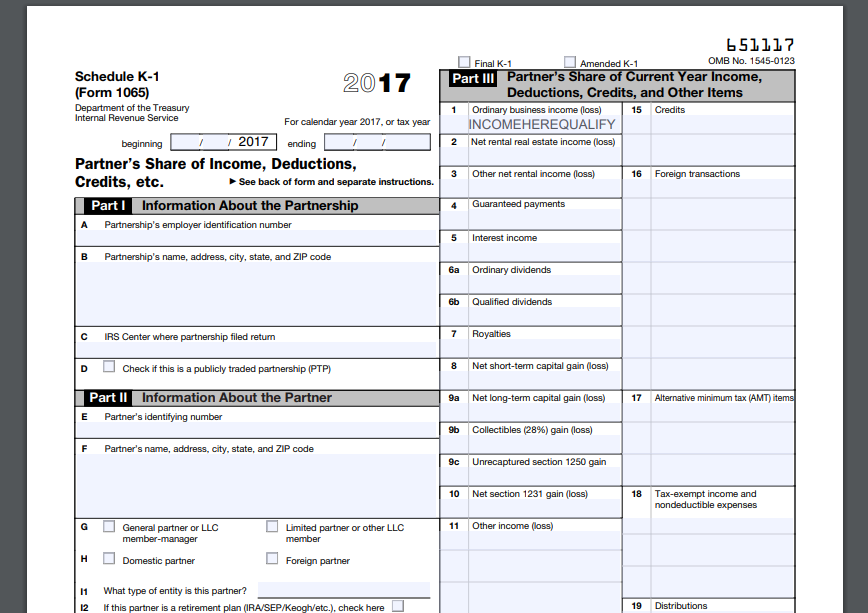

If you have income in some places such as rental income, that is passive income, you might need to work with your CPA, business, or personal pay structure to move some of your compensation to Earned income. Below is an example K1, where box 1 is where earned income typically goes. The three types of income are earned income (qualifies) passive income, and portfolio income (these last two do not qualify)

What if I meet the other requirements below but do not have current self-employment income this year?

You can open a Solo K, but keep in mind you cannot contribute to it this year. If your self-employment income is inconsistent, you must be prepared for this fluctuation and how it might impact your ability to use the Solo K to its full potential.

2. Who is your business owned by?

You and your spouse are the only people who can own the business. There can be no other outside ownership, or you will potentially not qualify for the Solo 401(k) at Rocket Dollar.

If you have partners, and the ownership structure is not structured appropriately, this can bar you from eligibility for the solo 401(k). At this time, Rocket Dollar does not support multi-owner Solo 401(k) plans. Anyone can still qualify for a Self-Directed IRA at Rocket Dollar.

3. Do you have any employees?

To qualify for a Self-Directed Solo 401(k), you cannot have any full-time common law employees other than your spouse. You can have part-time employees, but if you hire full-time employees in the future, you will have to stop contributing or come up with another retirement plan solution (maybe a SEP-IRA)

My other business has employees... but not the one I want to connect to the Solo 401(k). Does that still count?

Yes, unfortunately. The IRS can see this as hiding a retirement plan from your employees in another business. If you have employees, you can be subject to "discrimination testing" to make sure that you are giving yourself retirement benefits or an employer match, that your other employees are also eligible for a fair employer match and able to contribute to retirement accounts.

In order to start a Solo K while having full-time employees in another business, you have to prove to your tax accountant and then be able to prove to the IRS that these businesses are not in a controlled group. Here is a link to the law.

If you ignore this and fail to prove to the IRS that your employees in your own company or another company are NOT eligible for the retirement plan you could be subject to forced retirement backpay or legal action from your employees as a violation of ERISA law by enforcement of the Department of Labor. (DOL) You should open a SEP IRA which is available at Rocket Dollar or a corporate 401(k) plan.

I qualify! is the Self-Directed Solo 401(k) right for me?

Hold up there. Check if the Solo 401(k) is something you want to do. The Solo 401(k) is very powerful but can be a more complicated product to administer for our customers compared to a Self-Directed IRA, which is simple and straightforward.

- Are you trying to save over $6,000 per year in tax-advantaged retirement dollars?

- Will you have consistently have sufficient self-employed income each year to meet your contribution goals?

- Are you trying to take out loans from your retirement account?

- Are you trying to save both Traditional and Roth Dollars, or do after-tax conversions? (Mega-Roth)

- Are you going to be doing matching or profit-sharing contributions? Can you handle calculating these contributions yourself or with a trusted CPA?

If you answered no to all or most of these questions, it might be best to stick with the IRA. You can read more about the Self-Directed IRA vs. the Self-Directed Solo 401(k) comparison here.

If it made more sense, a traditional IRA can have much more steady contributions each year as you will not have to worry about your Self Employment Income, hiring plans, or business structure.

Rocket Dollar encourages you to think hard about your current financial situation or visit a CPA if you need extra help. can still qualify for a Self-Directed IRA at Rocket Dollar. We would not want you to open a Solo 401(k) and have to shut it down shortly after moving money to it if we find out the Solo 401(k) is not right for you. You can feel free to contact our team at info@rocketdollar.com and 855-762-5383. We will assist you as much as we can, but specific income and tax questions might have to be reserved for your CPA.

Here is an example of box 1 in the K1 where your ordinary income would qualify for the Self-Directed Solo 401(k).

Want to read more?

- Reducing your tax burden using a Rocket Dollar Self-Directed Solo 401(k)

- Unlocking your access to funds with a Rocket Dollar Self-Directed Solo 401(k)

Was this article helpful?

Please sign in to leave a comment.