How do I fill out a W-9 for my IRA Trust?

Fill out the W-9 according to the steps outlined below. Many investment issuers and sponsors will ask you for a completed W-9.

If you have a Checkbook IRA with an LLC, you are in the wrong article. Please go here.

A W-9 is not always needed to complete an IRA investment, but many compliance, tax, and legal departments of investment issuers require it to be completed as part of their onboarding process and to take special note of your Self-Directed IRA's tax status and how it might differ from their average taxable clients. When requested, it is best to submit one to make sure your retirement account's tax status is tagged and known by their tax reporting team at the investment issuer’s internal records.

This article is designed to assist Rocket Dollar customers who have custody of their IRA Trust at Rocket Dollar’s partner Digital Trust.

If Digital Trust is your custody provider for a Direct Custody IRA, please contact the support team, and Digital Trust will generate a W-9 signed by the custodian.

Why would I fill out a W-9?

Your investment issuer or sponsor may ask for a W-9 form so they can handle tax reporting appropriately

Filling out the W-9

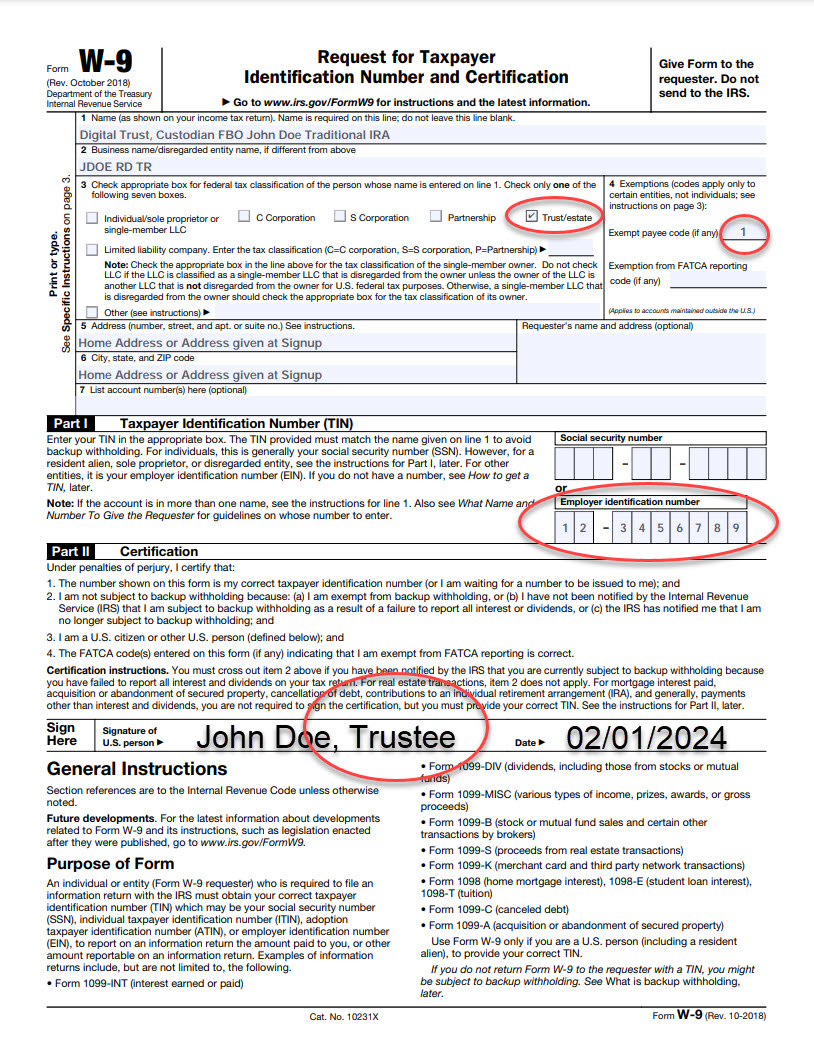

- For Line 1, use the following formula: Name of Custodian, FBO First Name Last Name IRA. For example, if you have a Rocket Dollar Checkbook IRA (a Self-Directed Traditional IRA Trust) your Line 1 will say: "Digital Trust, Custodian FBO John Doe Traditional IRA." For Roth Checkbook IRAs, it would say Digital Trust, Custodian FBO John Doe Roth IRA

- For Line 2, enter your Trust name.

- For Line 3, check the box for a TRUST/ESTATE.

- For Line 4, enter "1" as the exempt payee code. This is important because this is how you indicate to your investment issuer/sponsor that your account is tax-exempt and is part of an IRA. It is referenced in page 3 of the W-9 IRS instructions.

- For Lines 5 and 6, enter the address for the Trust (e.g., 1111 Anywhere Avenue) For most customers, this address is the address you used when you signed up for Rocket Dollar.

- For Part 1 Taxpayer Identification Number, enter the EIN of your IRA Trust in the box. If you need to find your EIN, you can go login, click profile, documents,

- For Part 2, sign your name, and you can include "Trustee" as your title on the signature line if there is room.

Download and print a blank W-9 from the IRS here. See the example below.

Was this article helpful?

Please sign in to leave a comment.